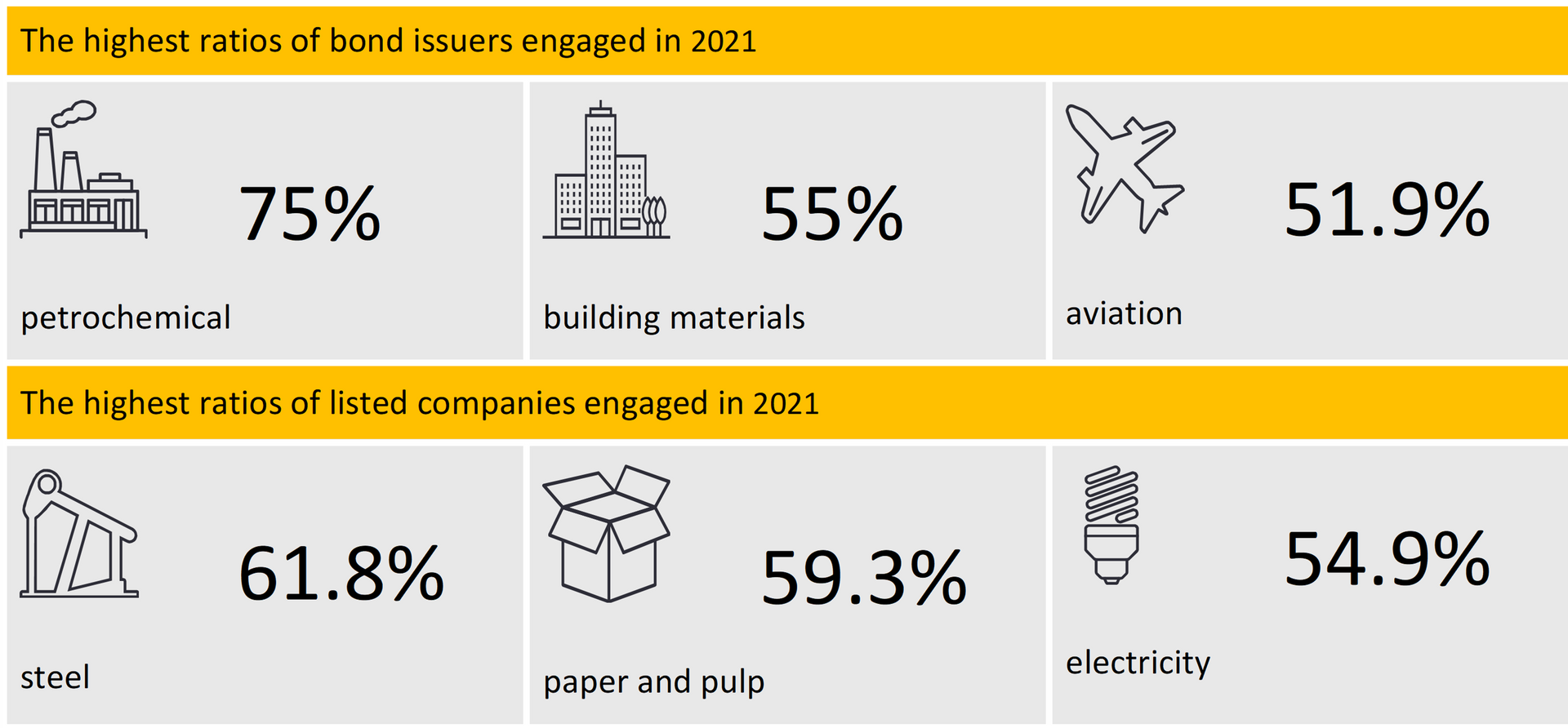

Disclosure ratios in different industries vary greatly, and were much higher in the eight energy-intensive industries than other industries. In 2021, the highest ratios of bond issuers engaged in petrochemical (75%), building materials (55%) and aviation (51.9%), listed companies in steel (61.8%), paper and pulp (59.3%) and electricity (54.9%) demonstrated the highest disclosure ratios.

Large companies disclosed ESG much more than small companies. More than half of bond issuers with assets over RMB200 billion (USD29 billion) issued ESG-related reports in 2021, compared to only 15% for issuers with assets under RMB50 billion. The disclosure ratio in 2021 was 93.8% for listed companies with a market value of more than RMB100 billion, while the ratios were 22.7% and 13.4%, respectively, for companies with a market value of RMB5-10 billion and less than RMB5 billion.

Of the 8,660 sample companies, 1,375 had set carbon emissions targets and measures in 2021, compared to 847 in 2018.